Trading success requires a thorough appreciation of the overall market trend, trading horizons and beyond, combined with a clear understanding of when the market is ‘overextended’ and ready to reverse. This is where ATTMO comes in…

Created by renowned financial pioneer Richard Olsen, and powered by Lykke, ATTMO is a weather-inspired tool that generates potent trading signals to help traders to optimise the timing of their trades and generate greater returns. Below, you will discover further details about ATTMO's background and instructions on its usage.

If you have found ATTMO to be useful and would like to share it with others, that's great! We have made some tools to help with this process. ATTMO Image Generator allows you to generate an image that can be shared on social media, or your blog posts, or wherever. You can configure it to show the instruments and time frames that you are interested in.

Alternatively, if you would like to embed ATTMO into one of your websites, you can use the ATTMO Code Generator to configure and generate the code to add to your page, in three easy steps.

Background

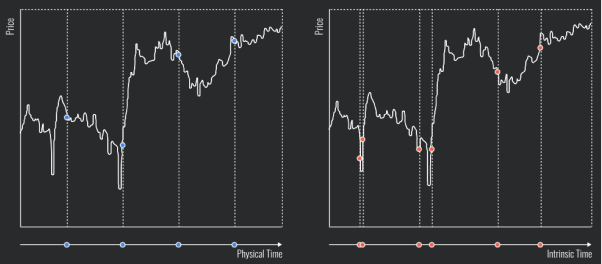

Calendar time is static and therefore prevents models from correctly differentiating between super active periods when prices are kicked around and quiet periods when nothing is happening. Action in financial markets is triggered by a multitude of unexpected events, where a news story breaks and ‘all hell breaks loose’, so if models have to wait until a certain amount of calendar time has elapsed for data to be included in the algorithm, the model response is too late and losses are incurred.

Intrinsic time is dynamic, so when markets are quiet or closed such as over weekends, the intrinsic clock stands still. At other times, when markets are in full swing, prices move up and down and important news occurs, so the intrinsic clock ticks at a rapid pace. The most profound benefit of intrinsic time is that the model automatically kicks in when markets are moving and things are happening. Thus, it automatically focuses on what is relevant for achieving good performance.

How to use ATTMO

Attmo uses a predictive model, based on the concept of ‘intrinsic time’ [1] to identify different market states.

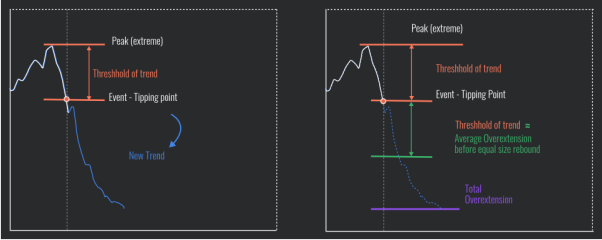

The intrinsic event happens as soon as the price has reversed by the indicator threshold from its recent peak. Such an event signals the start of a new trend. The new trend is likely, according to empirical evidence presented in [2], to continue in the same direction by the threshold amount. This information creates a better estimate of a potential closing price of the position, allowing a trader to lock in more value and avoid closing the position too soon.

If the trend overshoots and exceeds the threshold, then the state is set to ‘overextended’ conditional to detailed algorithm specifications. An overextended state signals a high probability of trend reversal and suggests a good time to close the existing position and/or open a new one.

There is a long way between having a good predictive indicator and having a fully automated trading bot that can take trading decisions without external intervention. The realisation of a successful trading system driven by ‘intrinsic time’ events can be found in.

Our journey together has just begun.

Feedback Welcome

Attmo is a breakthrough tool that is being made available free to early adopters to experiment with. As one of our earliest pioneers, we would be delighted if you would share any feedback you might have here.

References

[1] Introduction to high frequency finance. M. Dacorogna, R. Gençay, U. Müller, R. Olsen, O. Pictet at Academic Press. 2001

[2] Patterns in high-frequency FX data: Discovery of 12 empirical scaling laws. January 2008, Quantitative Finance 11(0809.1040) by J. Glattfelder, A. Dupuis and R. Olsen

[3] The Alpha Engine: Designing an Automated Trading Algorithm by Anton Golub, James B. Glattfelder, Richard B. Olsen in Anton Golub, James B. Glattfelder, Richard B. Olsen in book High-Performance Computing in Finance, 1st Edition, 2017, Chapman and Hall/CRC

[4] A new economics for a new age: Reconciling old-world systems with modern technology

[5] The existing economic models are flawed